Introduction: More Than Just Volatility

When most people think of risk in the crypto world, they picture wild price swings and sudden crashes. But volatility, though dramatic, is only the beginning. Beneath the surface lies a tangled web of hidden crypto threats that can blindside even seasoned investors.

In this article, we go beyond the headlines to uncover seven critical crypto threats that are quietly undermining portfolios—and share practical ways to protect your assets before it’s too late.

Understanding crypto threats is essential for safeguarding your investments.

One of the major crypto threats is regulatory uncertainty that can impact market stability.

Investors must navigate these crypto threats carefully to avoid potential pitfalls.

Awareness of these crypto threats can lead to more informed investment choices.

Take action against these crypto threats to protect your financial future.

Investors should be vigilant about emerging crypto threats that may affect their holdings.

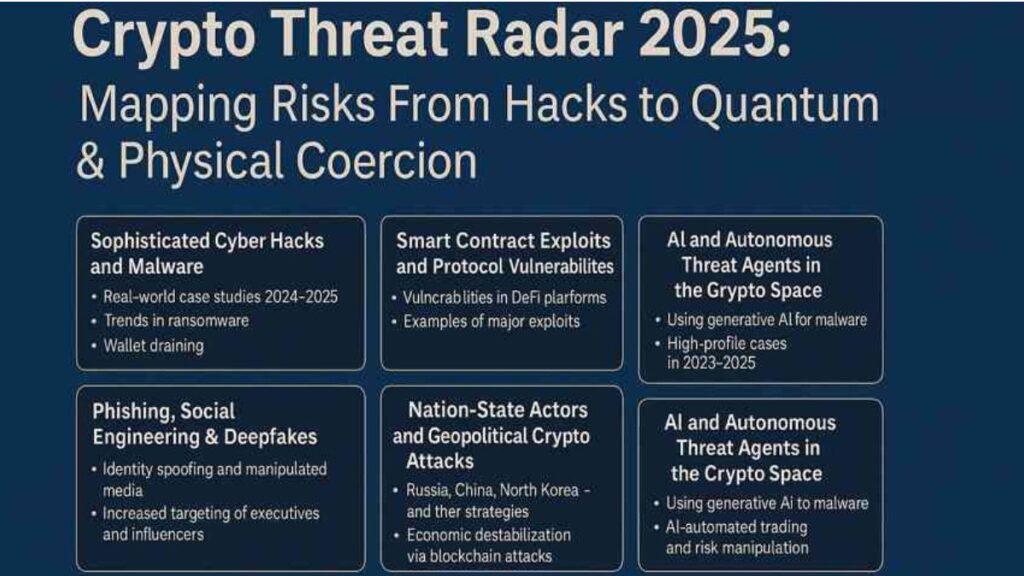

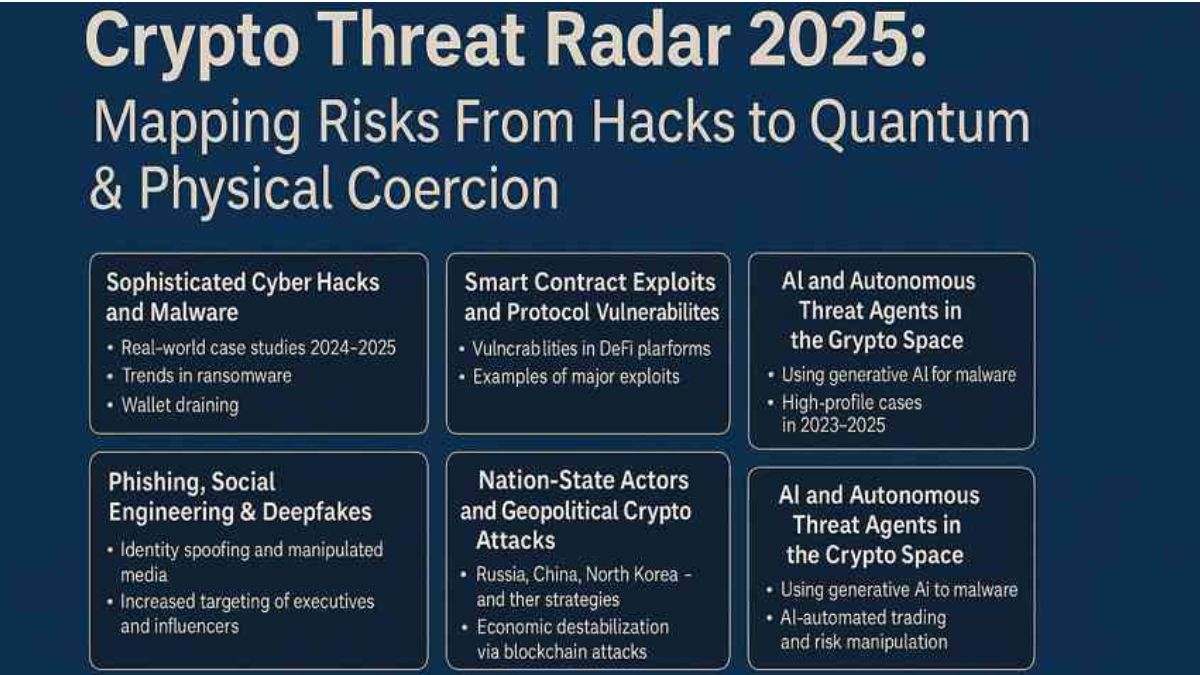

Threat #1: Regulatory Uncertainty and Legal Risks

As governments race to catch up with crypto innovation, regulations remain a patchwork of unclear and shifting rules.

Mitigating these crypto threats is vital for long-term success in the market.

Smart contract security is crucial in addressing prevalent crypto threats.

Protecting your investments from smart contract-related crypto threats should be a priority.

Be aware of the crypto threats that can arise from poorly executed smart contracts.

Understanding the implications of crypto threats can lead to better decision-making.

Impact of Sudden Regulation

Sudden bans, like China’s blanket prohibition on crypto transactions or the SEC cracking down on crypto exchanges, can devastate investments overnight. The lack of clear guidelines keeps investors in limbo, unable to predict how laws might change.

Custodial risks are among the top crypto threats to be mindful of.

Investors must combat custodial crypto threats by opting for self-storage solutions.

Learning about exchange failures helps investors recognize potential crypto threats.

Global Variations in Crypto Laws

What’s legal in one country might be outlawed in another. U.S. investors, for example, face different tax implications than those in Europe or Asia. This regulatory fragmentation means global crypto users need to stay hyper-aware of local laws.

Threat #2: Smart Contract Exploits

Different crypto threats necessitate diverse security strategies.

Rug pulls and scams are significant crypto threats in the current market.

Awareness of fraud-related crypto threats can protect your investments.

DeFi projects rely heavily on smart contracts, but bugs in the code can be catastrophic.

Identifying crypto threats early can save investors from substantial losses.

Common Vulnerabilities in DeFi Platforms

From reentrancy bugs to flash loan attacks, smart contract vulnerabilities have allowed hackers to siphon off hundreds of millions in crypto.

Real-World Hacks and Their Consequences

The infamous Wormhole Bridge hack in 2022 saw over $320 million vanish due to a smart contract flaw. Such incidents highlight the importance of choosing platforms that have undergone third-party audits and maintain bug bounty programs.

Threat #3: Custodial Risk and Exchange Failure

Investors should be aware of the evolution of crypto threats over time.

Network vulnerabilities are often overlooked crypto threats that require attention.

Understanding technical crypto threats can lead to safer investments.

Trusting a third-party to hold your crypto is inherently risky.

Centralized Exchange Collapses

The collapse of FTX in 2022 was a wake-up call. Customers lost billions due to mismanagement and lack of transparency. It showed that even the most “respected” exchanges can crumble overnight.

The Importance of Cold Storage and Self-Custody

Social engineering is a growing crypto threat that every investor should recognize.

True control means self-custody. Hardware wallets like Ledger and Trezor allow users to store assets offline, beyond the reach of exchange hacks or shutdowns.

Threat #4: Rug Pulls and Pump-and-Dump Schemes

New coins and meme tokens can be fun—but many are designed to scam.

How Bad Actors Manipulate New Tokens

Unsuspecting investors are lured into buying tokens with slick marketing and fake endorsements. Once the price spikes, insiders dump their holdings, crashing the value.

Warning Signs to Watch For

- Anonymous dev teams

- No audit or roadmap

- Sudden price spikes without fundamentals

- High token concentration in a few wallets

Threat #5: Network Attacks and Protocol Failures

The underlying infrastructure of blockchain isn’t invincible.

51% Attacks and DDoS on Blockchain Networks

In a 51% attack, malicious actors control the majority of a network’s hash rate, allowing double-spending. Smaller coins like Ethereum Classic have suffered multiple 51% attacks.

Implementing safeguards against phishing crypto threats can enhance security.

Technical Defenses and Resilience Strategies

Projects with strong community governance and diversified node operators are more resistant. Always research the security model of a blockchain before investing.

Threat #6: Social Engineering and Phishing Attacks

Hackers don’t always need code—they can trick you into handing over your assets.

Common Crypto-Targeted Scams

- Fake giveaways on social media

- Impersonation of support agents

- Phishing emails with fake login pages

Best Practices for Personal Cybersecurity

- Use hardware wallets

- Enable two-factor authentication

- Never click on suspicious links

- Bookmark official exchange URLs

Threat #7: Privacy Erosion and Surveillance

While blockchains are often considered anonymous, they’re usually pseudonymous and traceable.

Blockchain Traceability Concerns

Anyone can follow the flow of funds using explorers like Etherscan. This visibility can expose wallet balances and transaction history.

Tools and Coins Offering Enhanced Anonymity

Coins like Monero (XMR) or privacy features like CoinJoin help obscure your trail. Use VPNs and avoid reusing addresses for added privacy.

Protecting Your Crypto: Proactive Measures That Work

A few smart steps can vastly improve your crypto safety.

Diversification and Wallet Hygiene

Never keep all your assets in one wallet or one type of investment. Use separate wallets for trading and long-term holding.

Using Hardware Wallets and Multi-Signature Setups

Hardware wallets protect against online threats, while multi-sig wallets require multiple approvals for transactions—ideal for shared funds or institutional investments.

Risk Assessment Strategies for Crypto Investors

Treat crypto like any other asset: manage risk with discipline.

How to Evaluate Your Exposure

Ask:

- What percentage of your portfolio is in crypto?

- Are you over-reliant on a single token or platform?

Tools and Services That Help Manage Crypto Risk

Use portfolio trackers like Zerion or DeBank, and consider using insurance options such as Nexus Mutual for DeFi protocols.

Staying Ahead: How to Monitor Emerging Threats

Information is your best weapon.

Keeping Up with Threat Intelligence

- Follow security experts on Twitter

- Subscribe to newsletters like Bankless or The Defiant

Following Reliable Security Researchers and Forums

Platforms like Reddit’s r/CryptoCurrency, GitHub, and CoinGecko’s News Feed are great for staying informed.

Leveraging Insurance and Legal Protections

While limited, crypto insurance is growing.

Crypto Insurance Options

Services like InsurAce.io and Nexus Mutual offer coverage for smart contract failures and exchange hacks.

Legal Structures for Asset Protection

Consider setting up LLCs or trusts for large crypto holdings. This can provide a legal barrier and tax benefits.

Case Studies: Lessons from High-Profile Crypto Losses

Breakdown of Major Failures and Hacks

- FTX – Misuse of customer funds

- Mt. Gox – Poor security led to the loss of 850,000 BTC

- Poly Network – $600M exploit, later returned

What Investors Should Have Done Differently

- Avoid storing funds on centralized exchanges

- Regularly audit their security practices

- Diversify and monitor platform health

Expert Tips on Long-Term Crypto Security

Security isn’t one-time—it’s continuous.

Advice from Blockchain Security Pros

- “Don’t chase high returns without checking audits.” — Trail of Bits

- “Assume everything is vulnerable unless proven otherwise.” — Immunefi

Building a Resilient Crypto Investment Strategy

- Combine tech and financial safety nets

- Plan for worst-case scenarios

- Treat private keys like gold

Q1: Is it safe to keep crypto on Coinbase or Binance?

A: It’s safer than smaller exchanges, but self-custody is always more secure.

How can I tell if a crypto project is a scam?

Red flags include no audit, an anonymous team, and overhyped promises

Are hardware wallets truly hack-proof?

They’re among the safest options, especially when paired with secure handling practices.

What’s the best way to secure DeFi investments?

Use audited protocols, diversify, and consider insurance.

Can someone track my Bitcoin transactions?

Yes, unless you use mixers or privacy techniques.

What legal structure should I use to protect my crypto?

Consult a tax attorney about LLCs, trusts, or offshore options.

Conclusion: A Safer Future for Crypto Investors

Crypto’s promise is enormous—but so are its risks. By understanding the less obvious threats and implementing smart protective measures, investors can ride the digital wave without being swept away.

Stay informed about crypto threats, stay cautious, and treat your crypto portfolio with the same seriousness you’d give to real estate or stocks. In this fast-moving world, security isn’t optional—it’s essential.

Investors must prioritize monitoring for emerging crypto threats.

1 thought on “Crypto Threats: Protect Your Investments from 7 Risks”